20-F: Annual and transition report of foreign private issuers pursuant to Section 13 or 15(d)

Published on March 27, 2024

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 20-F

(Mark One)

REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|||||

OR

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|||||

For the fiscal year ended December 31 , 2023

OR

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|||||

OR

SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|||||

For the transition period from to

Commission file number: 001-38203

(Exact name of Registrant as specified in its charter) | ||

Not applicable

(Translation of Registrant’s name into English) | ||

| (Jurisdiction of incorporation or organization) | ||

(Address of principal executive offices) | ||

Phone: (888 ) 652-2848

Email: Arthur.Giterman@prometheanworld.com

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person) | ||

Securities registered or to be registered pursuant to Section 12(b) of the Act.

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||||||

American depositary shares, each representing 10 ordinary shares

par value US$0.001 per share* |

||||||||

Securities registered or to be registered pursuant to Section 12(g) of the Act.

None

(Title of Class) | ||

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act.

None

(Title of Class) | ||

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report.

As of December 31, 2023, there were 456,477,820 ordinary shares outstanding, par value US$0.001 per share.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ☐ Yes ☒ No

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

☐ Yes ☒ No

Note – Checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 from their obligations under those Sections.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

☒ Yes ☐ No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

☒ Yes ☐ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See definition of “large accelerated filer,"accelerated filer,” and "emerging growth company" in Rule 12b-2 of the Exchange Act.

Large accelerated filer ☐ |

Accelerated filer ☐ |

||||||||||

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange Act. ☐

† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b) by the registered public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| ☒ | International Financial Reporting Standards as issued by the International Accounting Standards Board | ☐ | Other | ☐ | |||||||||||||

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow. ☐ Item 17 ☐ Item 18

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ☐ Yes ☒ No

(APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PAST FIVE YEARS)

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court.

☐ Yes ☐ No

1

TABLE OF CONTENTS

| Page | |||||

| INTRODUCTION | |||||

| FORWARD-LOOKING STATEMENTS | |||||

| A. Reserved | |||||

| B. Capitalization and Indebtedness | |||||

| C. Reasons for the Offer and Use of Proceeds | |||||

D. Risk Factors |

|||||

A. History and Development of the Company |

|||||

| B. Business Overview | |||||

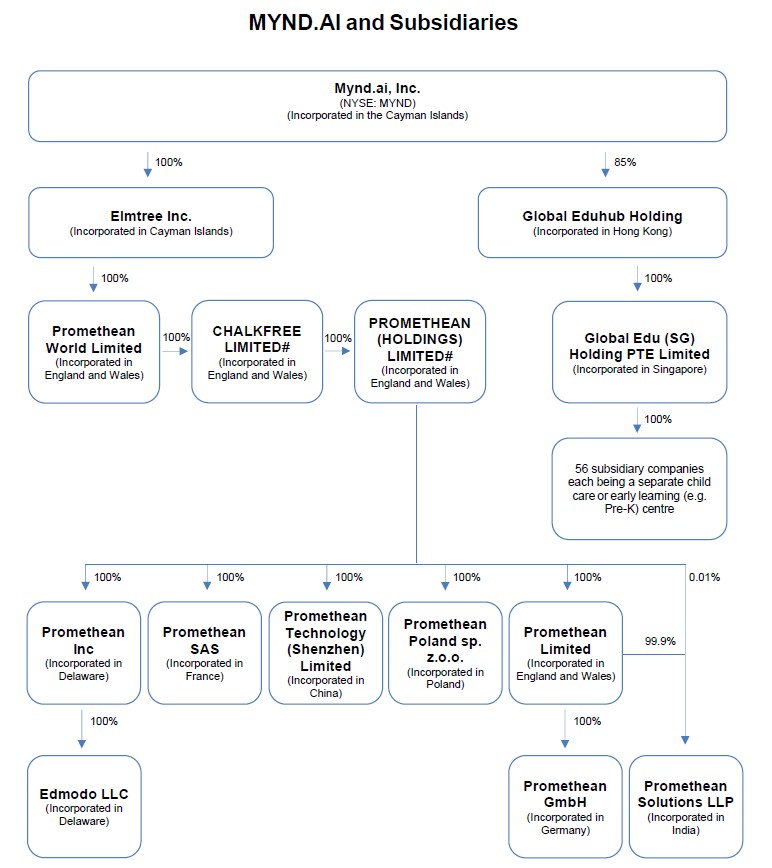

| C. Organizational Structure | |||||

| D. Property, Plant and Equipment | |||||

ITEM 4A. UNRESOLVED STAFF COMMENTS |

|||||

A. Operating Results |

|||||

B. Liquidity and Capital Resources |

|||||

C. Research and Development, Patents and Licenses |

|||||

D. Trend Information |

|||||

E. Critical Accounting Estimates |

|||||

| A. Directors and Senior Management | |||||

| B. Compensation | |||||

C. Board Practices |

|||||

D. Employees |

|||||

| E. Share Ownership | |||||

F. Disclosure of registrant’s action to recover erroneously awarded compensation |

|||||

ITEM 7. MAJOR SHAREHOLDERS AND RELATED PARTY TRANSACTIONS |

|||||

| A. Major Shareholders | |||||

B. Related Party Transactions |

|||||

| C. Interests of Experts and Counsel | |||||

| A. Consolidated Statements and Other Financial Information | |||||

B. Significant Changes |

|||||

2

| A. Disclosure Controls and Procedures | |||||

| B. Management’s Annual Report on Internal Control over Financial Reporting | |||||

| C. Attestation Report of the Registered Public Accounting Firm | |||||

D. Changes in Internal Control Over Financial Reporting |

|||||

SIGNATURES |

|||||

3

INTRODUCTION

As used in this Annual Report on Form 20-F (this “Annual Report”), unless the context otherwise requires or otherwise states, references to the “Company,” “Mynd,” “we,” “us,” “our,” and similar references refer to Mynd.ai, Inc., a company formed under the laws of the Cayman Islands, and its subsidiaries.

FORWARD-LOOKING STATEMENTS

This Annual Report contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 and other U.S. federal securities laws. These statements relate to our current expectations and views of future events, and involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements to be materially different from those expressed or implied by the forward-looking statements.

You can identify some of these forward-looking statements by words or phrases such as “may,” “will,” “expect,” “anticipate,” “aim,” “estimate,” “intend,” “plan,” “believe,” “is/are likely to,” “potential,” “continue” or other similar expressions. We have based these forward-looking statements largely on our current expectations and projections about future events that we believe may affect our financial condition, results of operations, business strategy and financial needs. These forward-looking statements include, but are not limited to, statements relating to:

•our goals and strategies;

•our future business development, financial conditions and results of operations;

•our expectations regarding demand for our educational products and services;

•our ability to attract and retain customers;

•our ability to develop new products and improve and enhance our existing solutions to address additional applications and markets;

•our competitiveness and ability to adapt to technological developments in the use of artificial intelligence;

•our ability to attract, retain and motivate qualified personnel;

•the effect of the recent Merger (hereinafter defined) on our ability to maintain relationships with our customers and business partners, or on our operating results and business generally;

•our cash needs and financing plans;

•competition in our industry;

•our ability to protect ourselves against cybersecurity risks and threats;

•our ability to protect or monetize our intellectual property;

•our ability to maintain the listing of our securities on a national securities exchange; and

•relevant government policies and regulations relating to our industry.

You should read this Annual Report and the documents that we refer to in this Annual Report and have filed as exhibits to this Annual Report completely and with the understanding that our actual future results may be materially different from what we expect. Other sections of this Annual Report discuss factors which could adversely impact our business and financial performance. Moreover, we operate in an evolving environment. New risk factors emerge from time to time and it is not possible for our management to predict all risk factors, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. We qualify all of our forward-looking statements by these cautionary statements.

You should not rely upon forward-looking statements as predictions of future events. The forward-looking statements made in this Annual Report relate only to events or information as of the date on which the statements are made in this Annual Report. Except as required by law, we undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise, after the date on which the statements are made or to reflect the occurrence of unanticipated events.

4

PART I

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISORS

Not Applicable.

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE

Not Applicable.

ITEM 3. KEY INFORMATION

Corporate Overview and Structure

Mynd.ai, Inc. (“Mynd” or the “Company”) is a Cayman Islands exempted company and conducts its business through various subsidiaries. Our operations are principally focused in the United States ("U.S."), Europe, the United Kingdom ("U.K."), and Singapore. Unless otherwise indicated, all references to the “Company”, “we”, “us”, our” shall mean the Company and its subsidiaries. For more information on our subsidiaries, please see Item 4C below.

A. [Reserved]

B. Capitalization and Indebtedness

Not Applicable.

C. Reasons for the Offer and Use of Proceeds

Not Applicable

D. Risk Factors

The following discussion summarizes material factors that could make an investment in us speculative or risky and should be considered carefully. These risks are interrelated and you should treat them as a whole. Additional risks and uncertainties not presently known to us may also materially and adversely affect our business operations, the value of our ordinary shares/American Depository Shares ("ADS") and our ability to pay dividends to our shareholders. In connection with the forward-looking statements that appear in this Annual Report, in these risk factors and elsewhere, you should carefully review the section above entitled “Forward-Looking Statements.”

Risks Related to our Business and Industry

We generate a substantial portion of our revenue from the sale of large format interactive display products, and any significant reduction in the sales of these products would materially harm our business.

We currently generate a majority of our revenue from the sale of large format Interactive Flat Panel Display (IFPD) products. A decrease in demand for our interactive flat panel displays would significantly reduce our revenue. If any of our competitors introduce attractive alternatives to their interactive flat panel displays, we could experience a significant decrease in our sales as customers migrate to those alternative products, which could have a material adverse effect on our business, financial condition or results of operation.

As a result of market saturation, future sales of interactive displays in developed markets may slow or decrease.

As a result of the high levels of penetration in certain developed markets, such as the U.S., U.K., Denmark and the Netherlands, the education market for interactive flat panel displays may reach saturation levels. Future sales growth in those markets and other developed markets with similar penetration levels may, as a result, be difficult to achieve, and the Company’s sales of interactive flat panel displays may decline in those countries. If we are unable to replace the revenue and earnings that we have historically derived from sales of interactive flat panel displays to

5

the education market in these developed markets, our business, financial condition and results of operations may be materially adversely affected.

Our business is subject to seasonal fluctuations, which may cause our operating results to fluctuate from quarter-to-quarter and adversely affect our working capital and liquidity throughout the year.

Our revenues and operating results normally fluctuate as a result of seasonal variations in our business, driven largely by the purchasing cycles of the educational market. Since the majority of our revenue is driven by U.S. sales and since the bulk of expenditures by school districts occur in the second and third calendar quarters after receipt of budget allocations, we expect quarterly fluctuations in our revenues and operating results to continue. These fluctuations could result in volatility and adversely affect our cash flow. As our business grows, these seasonal fluctuations may become more pronounced. As a result, we believe that sequential quarterly comparisons of our financial results may not provide an accurate assessment of our financial position.

Fluctuations in foreign currency exchange rates could harm our financial performance.

We are subject to inherent risks attributed to operating in a global economy. The Company generates approximately 71% of its revenue in the U.S., and 29% of its revenue from outside of the U.S., and the majority of our international sales are denominated in foreign currencies. As a result, any movement in the exchange rates between U.S. dollars and the currencies in which we conduct sales in foreign countries may affect our performance. For example, fluctuations in foreign currencies such as the Sterling, Euro and Chinese Yuan, could have an adverse impact on our revenue and operating results. Gains or losses from the revaluation of certain cash balances, accounts receivable, and intercompany balances that are denominated in these currencies will then also adversely impact our net (loss) income.

We rely on highly skilled personnel, and, if we are unable to attract, retain or motivate qualified personnel, we may not be able to operate our business effectively.

Our success depends in large part on continued employment of senior management and key personnel who can effectively operate our business, as well as our ability to attract and retain skilled employees. Competition for highly skilled management, technical, research and development (or "R&D") and other employees is intense in the high-technology industry and we may not be able to attract or retain highly qualified personnel in the future. In making employment decisions, particularly in the high-technology industry, job candidates often consider the value of the equity awards they would receive in connection with their employment. Our long-term incentive programs may not be attractive enough or perform sufficiently to attract or retain qualified personnel.

Our success also depends on having highly trained financial, technical, recruiting, sales and marketing personnel. A shortage in the number of people with these skills or our failure to attract them could impede our ability to increase revenues from our existing products and services, ensure full compliance with federal, state and other applicable regulations, or launch new product offerings and would have an adverse effect on our business and financial results.

We rely on third-party contractors located in countries outside of the U.S. (including contractors employed by affiliated companies of our controlling shareholder) for development of our products, which exposes us to risks associated with doing business in that geographic area. If we are not able to continue to use those third-party contractors, our business, financial conditions, and results of operations may be adversely affected.

We use third-party contractors including contractors employed by affiliated companies of our controlling shareholder, who are located in China and other countries outside the U.S. to develop current and future product lines, and we expect to continue to use such third party contractors, which exposes us to risks associated with reliance on third-party contractors, including but not limited to:

•the failure of the third party to develop our products on-schedule, or at all, including if our third-party contractors give greater priority to the supply of other products over our products or otherwise do not satisfactorily perform according to the terms of the agreements between us and them;

•the termination or non-renewal of arrangements or agreements by our third-party contractors at a time that is costly or inconvenient for us;

6

•the breach by the third-party contractors of our agreements with them;

•the failure of third-party contractors to comply with applicable regulatory requirements;

•the failure of the third party to develop our products according to our specifications;

•the misappropriation or unauthorized disclosure of our intellectual property or other proprietary information, including our trade secrets and know-how.

In addition, any disruption in production or inability of our third-party contractors in China to develop products that meet our needs, whether as a result of a natural disaster, pandemics, trade disruptions or other causes, could impair our ability to operate our business on a day-to-day basis and to continue development of our product lines. For example, the Uyghur Forced Labor Prevention Act bans imports from China’s Xinjiang region unless it can be shown that the goods were not produced using forced labor and this legislation may have an adverse effect on global supply chains which could adversely impact our business and results of operations.

We operate in a highly competitive industry, and if we are not able to maintain or increase our market share, our business, financial condition and results of operations may be adversely affected.

We are engaged in the interactive education industry. It faces substantial competition from developers, manufacturers and distributors of interactive learning products and solutions, including interactive whiteboards, interactive flat panel displays and any comparable or competitive new products that may be offered in the future. The industry is highly competitive and characterized by frequent product introductions and rapid technological advances. These advances include, for example, substantially increased capabilities and use of interactive whiteboards, interactive flat panel displays and micro-computer-based logging technologies and combinations of them. We face increased competition from companies with strong positions in certain markets we serve, and in new markets and regions that we may enter. These companies manufacture and/or distribute new, disruptive or substitute products that compete for the pool of available funds that previously could have been spent on interactive flat panel displays and associated products. Increased competition (particularly from Chinese manufacturers) or other competitive pressures have and may continue to result in price reductions, reduced margins or loss of market share, any of which could have a material adverse effect on our business, financial condition or results of operations.

In addition, some of our customers are required to purchase equipment by soliciting proposals from a number of sources and, in some cases, are required to purchase from the lowest bidder. While we attempt to price our products competitively based upon the relative features they offer, our competitors’ prices and other factors, we are often not the lowest bidder and may lose sales to lower bidders.

Competitors may also be able to respond to new or emerging technologies and changes in customer requirements more effectively and faster than we can or devote greater resources to the development, promotion and sale of products than we can. Current and potential competitors may establish cooperative relationships among themselves or with third parties, including through mergers or acquisitions, to increase the ability of their products to address the needs of customers. If these interactive display competitors or other substitute or alternative technology competitors acquire significantly increased market share, it could have a material adverse effect on our business, financial condition or results of operations.

If we are unable to anticipate consumer preferences and successfully develop attractive products, we might not be able to maintain or increase our revenue or achieve profitability.

Our success depends on our ability to identify and originate product and industry trends as well as to anticipate and react to change in demands and preferences of customers in a timely manner. If we are unable to introduce new products or technologies in a timely manner or our new products or technologies are not accepted by our customers, our competitors may introduce more attractive products which would adversely impact our competitive position. Failure to respond in a timely manner to changing consumer preferences could lead to, among other things, lower revenues and excess inventory positions of outdated products.

7

If we are unable to continually enhance our products and to develop, introduce and sell new technologies and products at competitive prices and in a timely manner, our business will be harmed.

The market for interactive learning and collaboration solutions is still emerging and evolving. It is characterized by rapid technological change and frequent new product introductions, many of which may compete with, be considered as alternatives to or replace our interactive flat panel displays, such as tablet computers. Accordingly, our future success will depend upon our ability to enhance our products and to develop, introduce and sell new technologies and products offering enhanced performance and functionality at competitive prices and in a timely manner.

The development of new technologies and products involves time, substantial costs and risks. Our ability to successfully develop new technologies will depend in large measure on our ability to maintain a technically skilled research and development staff and to adapt to technological changes and advances in the industry. The success of new product introductions depends on a number of factors, including allocating sufficient research and development funding, allocating sufficient human resources, timely and successful product development, market acceptance, the effective management of purchase commitments and inventory levels in line with anticipated product demand, the availability of components in appropriate quantities and costs to meet anticipated demand, the risk that new products may have quality or other defects and our ability to manage distribution and production issues related to new product introductions. If we are unsuccessful in selling the new products that we develop and introduce, or any future products that we may develop, we may carry obsolete inventory and have reduced available working capital for the development of other new technologies and products.

If we are unable, for any reason, to enhance existing products and or develop, introduce and sell new products in a timely manner, or at all, in response to changing market conditions or customer requirements or otherwise, our business will be harmed.

Defects in our products can be difficult to detect before shipment. If defects occur, they could have a material adverse effect on our business.

Our products are highly complex and sophisticated and, from time to time, have contained and may continue to contain design defects or failures including software “bugs” or glitches that are difficult to detect and correct in advance of shipping. The occurrence of errors and defects in our products could result in loss of, or delay in, market acceptance of our products, including harm to our brand, and correcting such errors and failures in our products could require significant expenditure of capital by us. In addition, we are rapidly developing and introducing new products, and new products may have higher rates of errors and defects than our established products. The consequences of such errors, failures and other defects and claims could have a material adverse effect on our business, financial condition, results of operations and our reputation.

A failure to keep pace with developments in technology could impair our operations or competitive position.

Our business continues to demand the use of sophisticated systems and technology. These systems and technologies must be refined, updated and replaced with more advanced systems on a regular basis in order for us to meet our customers’ demands and expectations. We will need to respond to technological advances and emerging industry standards in a cost-effective and timely manner in order to remain competitive. The need to respond to technological changes may require us to make substantial, unanticipated expenditures. There can be no assurance that we will be able to respond successfully to technological change. If we are unable to respond to technological changes and meet customers’ demands and expectations in a timely basis or within reasonable cost parameters, or if we are unable to appropriately and timely train our employees to operate any of these new systems, our business could suffer. We also may not achieve the benefits that we anticipate from any new system or technology, and a failure to do so could result in higher than anticipated costs or could impair our operating results.

We may not be successful in our strategy to increase sales in the business and corporate markets.

A significant portion of our revenue has been derived from sales to the education market. Our business strategy contemplates expanding our sales in both the education market, as well as to the corporate sector. Successful expansion into the corporate market will require the Company to develop a unique offering specifically for the corporate market and to develop or acquire new software or partner with a third party to provide software that is attractive specifically to corporate customers. Additionally, we will be required to augment and develop new distribution and reseller relationships, and we may not be successful in developing those relationships. In addition,

8

widespread acceptance of our interactive solutions may not occur due to lack of familiarity with how our products work, the perception that our products are difficult to use and a lack of appreciation of the contribution they can make in the corporate market. In addition, our Promethean brands may be less recognized in these markets as compared to the education market. A key part of our strategy to grow in the corporate market is to develop strategic alliances with companies in the unified communications and collaboration sector, and there can be no assurance that these alliances will help us to successfully grow our sales in such market.

Furthermore, our ability to successfully grow in the corporate market depends upon revenue and cash flows derived from sales to the education market. As the education market represents a significant portion of our revenue and cash flow, we utilize cash from sales in the education market for our operating expenses. If we cannot continue to augment and develop new distributor and reseller relationships, market our brands, develop strategic alliances and innovate new technologies, we may not be successful in our strategy to grow in the corporate market.

We face significant challenges growing our sales in foreign markets.

For our products to gain broad acceptance in all markets, we may need to develop customized solutions specifically designed for each country in which we seek to grow sales and to sell those solutions at prices that are competitive in that country. If we are not able to develop, or choose not to support, customized products and solutions for use in a particular country, we may be unable to compete successfully in that country and our sales growth in that country will be adversely affected.

Growth in many foreign countries will require us to price our products competitively in those countries. In certain developing countries, we have been and may continue to be required to sell our products at prices significantly below those that we are currently charging in developed countries. Such pricing pressures could reduce our gross margins and adversely affect our revenue.

Our customers’ experience with our products will be directly affected by the availability and quality of our customers’ internet access. We are unable to control broadband penetration rates, and, to the extent that broadband growth in emerging markets slows, our growth in international markets could be hindered.

In addition, we may face lengthy and unpredictable sales cycles in foreign markets, particularly in countries with centralized decision making. In these countries, particularly in connection with significant technology product purchases, the Company has experienced recurrent requests for proposals, significant delays in the decision-making process and, in some cases, indefinite deferrals of purchases or cancellations of requests for proposals. If we are unable to overcome these challenges, the growth of our sales in these markets would be adversely affected, and we may be unable to recoup marketing costs, impairing our profitability.

We invest in research and development, and to the extent our research and development investments do not translate into new solutions or material enhancements to our current solutions, or if we do not use those investments efficiently, or such investments are not sufficient, our business and results of operations would be harmed.

A key element of our strategy is to invest in our research and development efforts to develop new products and improve and enhance our existing solutions to address additional applications and markets. If we do not spend our research and development budget efficiently or effectively on compelling innovation and technologies or if we do not invest enough in R&D, our business may be harmed and we may not realize the expected benefits of our strategy. Moreover, research and development projects can be technically challenging and expensive. The nature of these research and development cycles may cause us to experience delays between the time we incur expenses associated with research and development and the time we are able to offer compelling solutions and generate revenue, if any, from such investment. As a result of R&D cycles sometimes being delayed, there is a risk that employees working on those projects could exit the business midstream resulting in further delays in order to get new hires or existing employees up to speed on the projects. Additionally, anticipated customer demand for products or solutions that we are developing could decrease after the development cycle has commenced, rendering us unable to recover substantial costs associated with the development of such product or solution. If we expend a significant amount of resources on research and development and our efforts do not lead to the successful introduction or improvement of solutions that are competitive in our current or future markets, or if we do not invest sufficiently on research and development efforts, it would harm our business, financial condition and results of operations.

9

We may have difficulty in entering into and maintaining strategic alliances with large established third parties.

We have entered into and we may continue to enter into strategic alliances with third parties to gain access to new and innovative technologies and markets. These parties are often large, established companies. Negotiating and performing under these arrangements involves significant time and expense, and we may not have sufficient resources to devote to our strategic alliances, particularly those with companies that have significantly greater financial and other resources than we do. The anticipated benefits of these arrangements may never materialize, and performing under these arrangements may adversely affect our results of operations.

We are dependent on a limited number of third-party manufacturers and key suppliers for the components used in our products. Our suppliers may not be able to always supply components or products to us on a timely basis and on favorable terms, and as a result, our dependency on third party suppliers may adversely affect our revenues.

We do not manufacture any of the products we sell and distribute and, therefore, we rely on our suppliers for all products and components, and we depend on obtaining adequate supplies of quality components on a timely basis with favorable terms. Some of those components, as well as certain complete products that we sell are provided to us by only one key supplier or contract manufacturer. We are subject to disruptions in our operations if our sole or limited supply contract manufacturers decrease or stop production of components and products, or if such suppliers and contract manufacturers do not produce components and products of sufficient quantity. Alternative sources for our components are not always available. Many of our products and components are manufactured overseas. If we are not able to identify alternative sources for our components in a reasonable time or our sole or limited supply contract manufacturers are delayed in their ability to deliver components to us due to supply chain issues or otherwise, our business, financial condition and results of operations may be adversely affected.

In the event we need to and are unable to timely replace a major supplier with a supplier on substantially equivalent terms, we may be unlikely to meet demand for our products, which may materially adversely affect our business, financial condition and results of operations.

Reliance on third-party manufacturers and suppliers entails risks to which we would not be subject if we manufactured the components for our own products, including:

•reliance on the third parties for regulatory compliance and quality assurance;

•the possible breach of the manufacturing agreements by the third parties due to factors beyond our control or the insolvency of any of these third parties or other financial difficulties, labor unrest, natural disasters or other factors adversely affecting their ability to conduct their business; and

•possibility of termination or non-renewal of the agreements by the third parties, at a time that is costly or inconvenient for us, because of our breach of the manufacturing agreement or based on our own business priorities.

If our contract manufacturers or our suppliers fail to deliver the required commercial quantities of its components required for our products on a timely basis and at commercially reasonable prices, and we are unable to find one or more replacement manufacturers or suppliers capable of production at a substantially equivalent cost, in substantially equivalent volumes and quality, and on a timely basis, we would likely be unable to meet demand for our products, and we would lose potential revenue. It may also take a significant period of time to establish an alternative source of supply for our components, which may materially adversely affect our business, financial condition and results of operations.

We, like many other technology companies, rely on microchips and other components to develop our product line, which may face global shortage and supply chain issues, which could negatively affect our business, financial condition, and results of operations.

We rely on microchips and other components to develop our product line and any chip shortages and supply chain constraints would have an adverse impact on our ability to deliver products in a timely manner and increase our cost of sales due to rising prices for materials. In addition, long lead times for components, and events such as local disruptions, natural disasters or political conflict may cause unexpected interruptions to the supply of our products or components. Any such extended lead times for components or other significant adverse impacts on our supply chain could disrupt or delay our scheduled product deliveries to our customers, resulting in inventory

10

shortage, causing loss of sales and customers or increase in component costs resulting in lower gross margins and free cash flow that could negatively affect our business, financial condition and results of operations.

An information security incident, including a cybersecurity breach (whether the incident or breach is the Company’s or one of our vendors), could have a negative impact on our business or reputation.

To meet business objectives, we rely on both internal information technology (IT) systems and networks, and those of third parties and their vendors, to process and store sensitive data, including confidential research, business plans, financial information, intellectual property, and personal data that may be subject to legal protection. The extensive information security and cybersecurity threats, which affect companies globally, pose a risk to the security and availability of these IT systems and networks, and the confidentiality, integrity and availability of our sensitive data. We continually assess these threats and make investments to increase internal protection, detection and response capabilities, as well as ensure our third-party providers have required capabilities and controls to address these risks. To date, we have not experienced any material impact to our business or operations resulting from information or cybersecurity attacks; however, because of the frequently changing attack techniques, along with the increased volume and sophistication of the attacks, there is the potential for us to be adversely impacted. This impact could result in reputational, competitive, operational or other business harm as well as financial costs and regulatory action. We maintain cybersecurity insurance in the event of an information security or cyber incident for our material legal entities; however, the coverage may not be sufficient to cover all financial losses or such losses may impact legal entities without cybersecurity insurance.

In addition, the risk of cybersecurity incidents has increased in connection with the ongoing war between Russia and Ukraine, driven by justifications such as retaliation for the sanctions imposed in conjunction with the war, or in response to certain companies’ continued operations in Russia. For example, the war has been accompanied by cyberattacks against the Ukrainian government and other countries in the region. It is possible that these attacks could have collateral effects on additional critical infrastructure and financial institutions globally, which could adversely affect our operations and could increase the frequency and severity of cyber-based attacks against our information technology systems. While we have taken actions to mitigate such potential risks, the proliferation of malware from the war into systems unrelated to the war or cyberattacks against U.S. companies in retaliation for U.S. sanctions against Russia or U.S. support of Ukraine, could also adversely affect our operations.

Government regulation of education and student information is evolving, and unfavorable developments could have an adverse effect on our results of operations.

We are subject to regulations and laws specific to the education sector because we offer solutions and services to students, collect data from students, and offer education and training. Data privacy and security with respect to the collection of personally identifiable information from minors and in particular, students, continues to be a focus of worldwide legislation and regulation. Within the U.S., dozens of states have enacted student data privacy legislation that goes beyond any federal requirements relating to the collection and use of personally identifiable information and other data from minors. Many of these laws impose direct liability on education technology ("EdTech") operators. California, for example, passed the Student Online Personal Information Protection Act ("SOPIPA") which went into effect in 2016 and is considered to be the most comprehensive student data privacy legislation in the U.S. that specifically addressed the changing nature of technology usage in schools by putting responsibility for compliance on the EdTech industry. SOPIPA expressly prohibits operators of a website, online service, or mobile application used primarily for K-12 school purposes from commercializing the collection of covered student data - either by selling it, using it to target advertisements to students or their families, or collecting it for any other noneducational purpose. It applies to any EdTech company regardless of whether they have a contract in place with the school or district. It also removes the idea of consent, meaning parents and students cannot consent to a company’s use of a student’s personal information for commercial purposes. Since the end of 2016, 33 states have introduced a version of California's SOPIPA or a similar piece of legislation that regulates our industry known as the SUPER (Student User Privacy in Education Rights) Act, and 12 states have passed those bills into law. SOPIPA and SUPER, and other recent student privacy laws impose direct liability on EdTech operators.

The continued passage of student data legislation could harm our business by causing schools and districts to be hesitant to do business with EdTech providers for fear of violating new legislation and we may be hesitant to develop new technology which collects student data for fear of running afoul of the new legislation thus resulting in a decrease in revenue. These decreases could be caused by, among other possible provisions, the required use of disclaimers or other requirements before students can utilize our services. We post our privacy policies and practices

11

concerning the use and disclosure of student data on our website. However, any failure by us to comply with posted privacy policies, FTC requirements or other privacy-related laws and regulations could result in proceedings by governmental or regulatory bodies or by private litigants that could potentially harm our business, results of operations, and financial condition.

We plan to offer products which feature artificial intelligence (AI). As this technology is new and developing, it may present both compliance risks and reputational risks, and may require strategic investments. We will need to maintain our competitiveness and any failure to adapt to technological developments or industry trends could harm our business. In addition, regulation and fear associated with use of AI enabled products could result in customers refraining from purchasing our products which could potentially harm our business, results of operations, and financial condition.

We plan to offer products and possibly services which feature artificial intelligence (AI) as a component. Given the rapid developments in artificial intelligence, we believe it is likely that the education market has not kept up with recent developments in AI and will thus lag behind other markets in terms of adoption of products which contain AI features and functionality. AI algorithms require massive amounts of data in order to learn and become intelligent enough to be effective. There is a natural suspicion that (i) AI technology may collect data, specifically personal data which is not permitted under applicable law, (ii) AI technology may produce images and text which might infringe on the intellectual property ownership rights of other parties, and (iii) AI technology may use inaccurate or unreliable data to generate the AI thus resulting in inaccurate results or ineffective uses. It is possible that the education market will be cautious in purchasing products which have an AI component for fear that they will inadvertently run afoul of applicable data privacy laws, specifically student data privacy laws, or infringe on third party intellectual property. Furthermore, AI algorithms are based on machine learning and predictive analytics, which can create unintended biases and discriminatory outcomes. We plan to continue to implement measures to address algorithmic bias as we utilize AI features for our products and services. However, there is always a risk that algorithms could produce discriminatory or unexpected results or behaviors (e.g., "hallucinatory behavior," which involves the generation of fabricated information in response to a user's prompt that is presented as factually accurate) that could harm our reputation, business, customers, or stakeholders.

In addition, the use of AI involves significant technical complexity and requires specialized expertise, which presents risks and challenges to the adoption of AI components in our products and services. For example, algorithms may be flawed or datasets may be insufficient, and we may need to hire additional employees with specialized skill sets necessary to address such deficiencies. Any disruption or failure in our AI systems or infrastructure could result in delays or errors in our operations, which could harm our business, results of operations and financial results. Any imposed halt in the adoption of our anticipated AI systems or infrastructure could also harm our business, results of operations and financial results. If we do not sufficiently invest in new technology and industry developments such as AI features and functionality, or if we do not make the right strategic investments to respond to these developments and successfully drive innovation, our services and solutions, our ability to generate demand for services, attract and retain clients, and our ability to develop and achieve a competitive advantage and continue to grow could be negatively affected.

Further, the emergence of competitors who may be able to optimize products, services or strategies that use advanced computing such as cloud computing, as well as other technological changes and developing technologies, such as machine learning and AI, have, and will require us to make new and costly investments. Transitioning to new technologies may be disruptive to resources and the services we provide and may increase our reliance on third party service providers. We may not be successful or may be less successful than our current or new competitors, in developing technology that operates effectively across multiple devices and platforms and that is appealing to our customers, either of which would negatively affect our business and financial performance. Moreover, given the rapid pace at which AI has advanced, there has been a push by legislators and even the private sector to consider regulation of AI such that it is not used in a potentially harmful way. The potential for regulation and the fears and suspicions associated with use of AI enabled products could result in customers refraining from purchasing our products which could potentially harm our business, results of operations, and financial condition.

12

We are subject to claims, suits, government investigations, other proceedings, and consent decrees, including a recent permanent injunction order issued by the FTC against Edmodo, LLC, a wholly owned subsidiary of the Company, regarding alleged violations of the Children’s Online Privacy Protection Act (COPPA), the Children’s Online Privacy Protection Rule (COPPA Rule), and the Federal Trade Commission Act. Orders similar to this can result in further scrutiny and further requirements imposed on our business which may result in limitations on our operations which may materially and adversely affect our business, financial condition, and results of operations.

We are subject to claims, suits, government investigations, other proceedings, and consent decrees involving competition, intellectual property, data privacy and security, consumer protection, tax, labor and employment, commercial disputes, content generated by our users, and, in connection with our discontinued Edmodo platform in the U.S., the collection and retention of student data and other matters. Due to our manufacturing and sale of an expanded suite of products and services, we are also subject to a variety of claims including product warranty, product liability, and consumer protection claims related to product defects, among other litigation. We may also be subject to claims involving health and safety, hazardous materials usage, other environmental effects, or service disruptions or failures.

In June 2020, the FTC issued a civil investigative demand to Edmodo. The matter concerned whether Edmodo violated Children’s Online Privacy Protection Act (COPPA), during the period of 2017 through 2021, as well as whether Edmodo's then current privacy practices were in compliance with these laws. On June 27, 2023, Edmodo, the Department of Justice and the FTC settled the matter by entering a permanent injunction against Edmodo. As of the date hereof, the Edmodo platform in the U.S. has been shut down, however, under the consent order, the Edmodoworld platform will likely remain subject to certain requirements. The Edmodoworld platform is scheduled to be discontinued on March 31, 2024. We have already provided notice to all users that the platform will be taken down at close of business on March 31, 2024. Users have been notified that all of their data will be permanently deleted as of April 1, 2024. Once that process is completed, Promethean intends to complete the final wind down of all Edmodo business and the liquidation of the entity will follow shortly thereafter.

Any of these types of legal proceedings can have an adverse effect on the Company because of legal costs, diversion of management resources, negative publicity and other factors. Determining reserves for our pending litigation is a complex, fact-intensive process that requires significant judgment by us. The resolution of one or more such proceedings has resulted in, and may in the future result in, additional substantial fines, penalties, injunctions, and other sanctions that could harm our business, financial condition, and operating results.

Privacy and data protection regulations are complex and rapidly evolving, and we collect, process, store and use personal information and data, which subjects us to governmental regulation and other legal obligations related to privacy; any failure or alleged failure to comply with these laws could harm our business, reputation, financial condition, and operating results.

Authorities around the world have adopted and are considering a number of legislative and regulatory proposals concerning data protection and limits on encryption of user data. Adverse legal rulings, legislation, or regulation have resulted in, and may continue to result in, fines and orders requiring that we change our data practices, which could have an adverse effect on our ability to provide services, harming our business operations. Complying with these evolving laws could result in substantial costs and harm the quality of our products and services, negatively affecting our business, and may be particularly challenging during certain times, such as a natural disaster or pandemic. Amongst others, we are and expect to continue to be subject to the following laws and regulations:

•The General Data Protection Regulation (GDPR), which applies to all of our activities conducted from an establishment in the EU or related to products and services that we offer to EU users or customers, or the monitoring of their behavior in the EU. Ensuring compliance with the range of obligations created by the GDPR is an ongoing commitment that involves substantial costs. If our operations are found to violate GDPR requirements, we may incur substantial fines, have to change our business practices, and face reputational harm, any of which could have an adverse effect on our business. Serious breaches of the GDPR can result in administrative fines of up to 4% of annual worldwide revenues. Fines of up to 2% of annual worldwide revenues can be levied for other specified violations;

•Various state privacy laws, such as the California Consumer Privacy Act of 2018 (CCPA), which came into effect in January of 2020; the California Privacy Rights Act (CPRA), which went into effect in January

13

2023; the Virginia Consumer Data Protection Act (Virginia CDPA), which went into effect in January 2023; and the Colorado Privacy Act (ColoPA), which went into effect on July 1, 2023; all of which give new data privacy rights to their respective residents (including, in California, a private right of action in the event of a data breach resulting from our failure to implement and maintain reasonable security procedures and practices) and impose significant obligations on controllers and processors of consumer data;

•SB-327 in California, which regulates the security of data in connection with internet connected devices; and

•Many state student data privacy laws which may differ from the consumer privacy laws in those states.

Further, we are subject to evolving laws and regulations that dictate whether, how, and under what circumstances we can transfer, process and/or receive personal data. On July 10, 2023, the European Commission adopted an adequacy decision for the EU-US Data Privacy Framework (“DPF”). The DPF is the successor to the EU-US privacy shield, which the Court of Justice of the European Union (CJEU) declared invalid in 2020. The adequacy decision means that U.S. businesses that self-certify under the DPF no longer require separate data transfer mechanisms in order to transfer personal data from the European Union to the U.S. Self-certified companies to the DPF will be able to freely transfer personal data from the European Economic Area to the U.S. without having to conduct a data transfer impact assessment (DTIA) or implement supplemental measures. However, any company which relies on other data transfer mechanisms, such as Standard Contractual Clauses (SCCs), may have to adapt its existing contractual arrangements to incorporate DTIA before transferring data. The validity of data transfer mechanisms remains subject to legal, regulatory, and political developments in both Europe and the U.S., such as recent recommendations from the European Data Protection Board, decisions from supervisory authorities, recent proposals for reform of the data transfer mechanisms for transfers of personal data outside the United Kingdom, and potential invalidation of other data transfer mechanisms, which, together with increased enforcement action from supervisory authorities in relation to cross-border transfers of personal data, could have a significant adverse effect on our ability to process and transfer personal data outside of the European Economic Area and/or the United Kingdom.

The requirements for incorporating DTIA to SCCs as well as complying with evolving laws and regulations in this area remains subject to interpretation, including developments which create some uncertainty, and further compliance obligations that could cause us to incur costs or harm the operations of our products and services in ways that harm our business. In addition, some countries are considering or have passed legislation implementing data protection requirements or requiring local storage and processing of data that could increase the cost and complexity of delivering our services and carries the potential of service interruptions in those countries, which could have an adverse effect on our business, financial condition and results of operation.

Our Promethean World Limited subsidiary is subject to compliance with a National Security Agreement with the U.S. Government. Failure to comply with the terms of this NSA could result in significant civil penalties.

Our Promethean World Limited subsidiary entered into a National Security Agreement (NSA) with the U.S. Government as a condition to closing the Merger (hereinafter defined). The NSA restricts Promethean from disclosing, transferring, or providing access to Protected Data (as defined in the NSA, including certain U.S.-based customer personally identifiable information) and subject to the terms of the Agreement to NetDragon or the Company. The NSA allows for annual audits by a third-party auditor to assess our compliance with the terms of the NSA. Any non-compliance or violations of the NSA may result in significant civil penalties and could potentially harm our business, financial results and our reputation.

Executive Order 13873 issued February 28, 2024 seeks to address the threat of China’s access to Americans' sensitive personal data and, may in time, adversely impact our business.

Executive Order 13873 (the "Order") was issued February 28, 2024 in order to protect Americans' sensitive personal data from exploitation by countries of concern. The Order authorizes the Attorney General to prevent the large-scale transfer of American’s personal data to countries of concern, provides safeguards around other activities that give those countries access to Americans’ sensitive data and directs the Department of Justice ("DOJ") to issue regulations that establish clear protections for Americans’ sensitive personal data from access and exploitation by countries of concern. Additionally, the Order directs the DOJ and Homeland Security to set high security standards to prevent access by countries of concern to Americans’ data through other commercial means such as data available via investment, vendor, and employment relationships. Given the uncertainty of what regulations and what standards

14

will result from the Order, it is uncertain at this time what impact, if any, the Order may have on the Company’s business, but compliance with additional data security regulations could result in an increase in our costs of operations and have an adverse impact on our results of operations.

We are subject to risks inherently related to our international operations.

Sales outside the U.S. represent a significant portion of our revenues. We have committed, and may continue to commit, significant resources to our international operations and sales and marketing activities.

Our significant international operations subject us to several risks related to these international business activities that may increase costs, lengthen sales cycles and require significant management attention. International operations carry certain risks and associated costs, such as the complexities and expense of administering a business abroad, complications in compliance with, and unexpected changes in regulatory requirements under or relating to, foreign laws, international import and export legislation, trading and investment policies, exchange controls, tariffs and other trade barriers, difficulties in collecting accounts receivable, potential adverse tax consequences, uncertainties of laws, difficulties in protecting, maintaining or enforcing intellectual property rights, difficulty in managing a geographically dispersed workforce in compliance with diverse local laws and customs, and other factors, depending upon the country involved. Moreover, local laws and customs in many countries differ significantly and compliance with the laws of multiple jurisdictions can be complex, difficult and costly. Risks inherent in our international operations may have a material adverse effect on our business.

Risks associated with climate change and other environmental impacts, and increased focus and evolving views of our customers, shareholders, and other stakeholders on climate change issues, could negatively affect our business and operations.

The effects of climate change can create short and long-term financial risks to our business, both in the U.S. and globally. We have significant operations located in regions that have been, and may in the future be, exposed to significant weather events and other natural disasters. Climate related changes can increase variability in or otherwise impact natural disasters, including weather patterns, with the potential for increased frequency and severity of significant weather events (e.g., flooding, hurricanes, and tropical storms), natural hazards (e.g., increased wildfire risk), rising mean temperature and sea levels, and long-term changes in precipitation patterns (e.g., drought, desertification, and/or poor water quality). We expect climate change could affect our facilities, operations, employees, and communities in the future, particularly at facilities in coastal areas and areas prone to extreme weather events and water scarcity. Our suppliers are also subject to natural disasters that could affect their ability to deliver or perform under our contracts, including as a result of disruptions to their workforce and critical infrastructure. Disruptions also impact the availability and cost of materials needed for manufacturing and could increase insurance and other operating costs.

We must comply with the U.S. Foreign Corrupt Practices Act as well as similar applicable anti-bribery laws around the world.

We are required to comply with the United States Foreign Corrupt Practices Act, which prohibits U.S. companies from engaging in bribery of or other prohibited payments to foreign officials for the purpose of obtaining or retaining business and requires that we maintain adequate financial records and internal controls to prevent such prohibited payments. Corruption, extortion, bribery, pay-offs, theft and other fraudulent practices may occur in countries where we do business. If our competitors engage in these practices, they may receive preferential treatment from personnel of some companies, giving our competitors an advantage in securing business or from government officials who might give them priority in obtaining new business, which would put us at a disadvantage. If our employees or other agents are found to have engaged in such practices, we could suffer severe penalties which could materially and adversely affect our financial condition and result in reputational harm.

Our worldwide operations will subject us to income taxation in many jurisdictions, and we must exercise significant judgment to determine our worldwide financial provision for income taxes.

We are subject to income taxation in the U.K., the U.S. and numerous other jurisdictions. Significant judgment is required in determining our worldwide provision for income taxes. Although we believe our tax estimates are reasonable, our ultimate income tax liability may differ from the amounts recorded in our financial statements. Any

15

additional income tax liability may have a material adverse effect on our financial results in the period or periods in which such additional liability arises.

Income tax law and regulatory changes in the U.S., the E.U. and other jurisdictions, including income tax law and regulatory changes that may be enacted by the U.S. federal and state governments or as a result of tax policy recommendations from organizations such as the Organization for Economic Co-operation and Development (the “OECD”), have and may continue to have an impact on our financial condition and results of operations.

Certain of our subsidiaries provide products to and may from time to time undertake certain significant transactions with us and our other subsidiaries in different jurisdictions. In general, cross-border transactions between related parties and, in particular, related party financing transactions, are subject to close review by tax authorities. Moreover, several jurisdictions in which we operate have tax laws with detailed transfer pricing rules that require all transactions with nonresident related parties to be priced using arm’s-length pricing principles and require the existence of contemporaneous documentation to support such pricing. A tax authority in one or more jurisdictions could challenge the validity of our related party transfer pricing policies. If in the future any taxation authorities are successful in challenging our financing or transfer pricing policies, our income tax expense may be adversely affected and we could become subject to interest and penalty charges, which may harm our business, financial condition and results of operations.

We are subject to non-income taxes in many jurisdictions in which we conduct business and significant judgement is required in determining our exposure for non-income taxes.

We are subject to non-income taxes, including withholding, sales, use, and value added taxes, in various jurisdictions in which we conduct business. Fiscal authorities in one or more of those jurisdictions may contend that our non-income tax liabilities are greater than the amounts we have accrued and/or reserved for. Moreover, future changes in non-income tax laws or regulations may materially increase our liability for such taxes in future periods.

Significant judgment is required in determining our exposure for non-income taxes. These determinations are highly complex and require detailed analysis of the available information and applicable statutes and regulatory materials. Although we believe our tax determinations are reasonable, tax authorities in certain jurisdictions may disagree. Moreover, certain jurisdictions in which we do not collect or pay withholding, sales, use, value added, or other non-income taxes may assert that such taxes are applicable, which could result in tax assessments, penalties and interest, and we may be required to collect or pay such taxes in the future.

If we are unable to ship and transport components and final products efficiently and economically across long distances and borders, our business would be harmed.

We transport significant volumes of components and finished products across long distances and international borders. Any increases in our transportation costs, as a result of increases in the price of oil or otherwise, would increase costs and the final prices of our products to customers. In addition, any increases in customs or tariffs, as a result of changes to existing trade agreements between countries or otherwise, could increase costs or the final cost of products to customers or decrease margins. Such increases could harm our competitive position and could have a material adverse effect on our business. The laws governing customs and tariffs in many countries are complex and often include substantial penalties for non-compliance. Disputes may arise and could subject us to material liabilities and have a material adverse effect on our business. It should be noted that the highly charged geopolitical climate between the U.S. and China has already resulted in the imposition of tariffs on the import of many of our products into the U.S. from China. To the extent that China takes any actions that are seen by the U.S. administration to be adverse in nature to the U.S. or its allies, the U.S. could institute additional tariffs or increase existing tariffs which could have a material adverse effect on our business.

If we are unable to ship and transport components and final products efficiently and economically due to violence and dangerous conditions in certain shipping routes, our business would be harmed.

We transport significant volumes of components and finished products across long distances and international waters. The consequences of piracy are far-reaching and multi-faceted. Shipping companies face increased insurance costs, higher security measures, and disruptions to their supply chains. There is an increased threat of violence and hostage-taking in several shipping routes between China and Europe and the U.S. The carriers we use may be unable to enter certain shipping routes as a result of dangerous conditions or potential violence due to these increased risks.

16

Such increased risks could cause the delivery of our products to be significantly delayed which could harm our competitive position and have a material adverse effect on our business.

If our procedures to ensure compliance with export control laws are ineffective, our business could be harmed.

Our extensive international operations and sales are subject to far reaching and complex export control laws and regulations in the U.S. and elsewhere. Violations of those laws and regulations could have material negative consequences for us including large fines, criminal sanctions, prohibitions on participating in certain transactions and government contracts, sanctions on other companies if they continue to do business with us and adverse publicity, any of which could have a material adverse effect on our business, financial condition and results of operation.

We may fail to realize some or all of the anticipated benefits of the Merger and related transactions (see Item 4A "History and Development of the Company"), which could adversely affect the value of our ADSs.

The achievement of the anticipated benefits of the Merger is subject to a number of uncertainties, including general competitive factors in the marketplace and whether we are able to integrate our business in an efficient and effective manner and establish and implement effective operational principles and procedures. Failure to achieve these anticipated benefits could result in increased costs, decreases in revenues and diversion of management’s time and energy, and could materially impact our business, cash flows, financial condition or results of operations. While we anticipate that the Merger will help us realize the anticipated growth opportunities and other benefits, we cannot predict with certainty if or when these growth opportunities and benefits will occur, or the extent to which they actually will be achieved. For example, the benefits from the Merger may be offset by costs incurred by us. These fees and costs have been, and will continue to be, substantial. Non-recurring transaction costs include, but are not limited to, fees paid to legal, financial and accounting advisors, filing fees and printing costs. Additional unanticipated costs may be incurred, which may be higher than expected and could have a material adverse effect on the combined company’s financial condition and operating results. If we are not able to successfully achieve these objectives, the anticipated cost savings, synergies, growth opportunities and other benefits that we expect to achieve as a result of the Merger may not be realized fully, or at all, or may take longer than expected to realize.

It is possible that the integration process could take longer or be more costly than anticipated or could result in the loss of key employees, the disruption of our ongoing business or inconsistencies in standards, controls, procedures and policies that adversely affect the ability of the combined company to maintain relationships with suppliers, customers and employees, to achieve the anticipated benefits of the Merger or maintain quality standards. An inability to realize the full extent of, or any of, the anticipated benefits of the Merger, as well as any delays encountered in the integration process, could have an adverse effect on the combined company’s business, cash flows, financial condition or results of operations, which may affect the value of our ADSs.

We have identified material weaknesses in our internal control over financial reporting and may identify additional material weaknesses in the future. Failure to remediate such material weaknesses in the future or to maintain an effective system of internal control could impair our ability to comply with the financial reporting and internal controls requirements for publicly traded companies.

As a public company, we are required to maintain internal control over financial reporting and to report any material weaknesses in such internal control. Section 404 of the Sarbanes-Oxley Act of 2002, or the Sarbanes-Oxley Act, requires that we evaluate and determine the effectiveness of our internal control over financial reporting and provide a management report on internal control over financial reporting. A material weakness is a deficiency or combination of deficiencies in internal control over financial reporting such that there is a reasonable possibility that a material misstatement of our financial statements will not be prevented or detected on a timely basis. As set forth in "Item 15 - Controls and Procedures," we have identified several material weaknesses in our internal controls over financial reporting, as well as our plans to mitigate and remediate such weaknesses.

While we believe that the actions we have taken and will continue to take as outlined in Item 15 below, will improve our internal control over financial reporting, the implementation of these measures is ongoing and will require validation and testing of the design and operating effectiveness of internal controls over a sustained period of financial reporting cycles. We cannot assure you that the measures we have taken to date, and are continuing to implement, will be sufficient to remediate the material weaknesses we have identified or avoid potential future

17

material weaknesses. If the steps we take do not correct the material weaknesses in a timely manner, we will be unable to conclude that we maintain effective internal controls over financial reporting. Accordingly, there could continue to be a reasonable possibility that these deficiencies or others could result in a misstatement of our accounts or disclosures that would result in a material misstatement of our financial statements that would not be prevented or detected on a timely basis.

The process of designing and implementing internal control over financial reporting required to comply with Section 404 of the Sarbanes-Oxley Act will be time consuming, costly and complex. If during the evaluation and testing process, we identify one or more other material weaknesses in our internal control over financial reporting or determine that existing material weaknesses have not been remediated, our management will be unable to assert that our internal control over financial reporting is effective. Even if our management concludes that our internal control over financial reporting is effective, and when required in the future, our independent registered public accounting firm may conclude that there are material weaknesses with respect to our internal controls or the level at which our internal controls are documented, designed, implemented or reviewed. If we are unable to assert that our internal control over financial reporting is effective, or when required in the future, if our independent registered public accounting firm is unable to express an opinion as to the effectiveness of our internal control over financial reporting, investors may lose confidence in the accuracy and completeness of our financial reports, the market price of our ADSs could be adversely affected and we could become subject to litigation or investigations by the stock exchange on which our securities are listed, the SEC or other regulatory authorities, which could require additional financial and management resources.

Fulfilling our obligations as a public company, including with respect to the requirements of and related rules under the Sarbanes-Oxley Act of 2002, and the Dodd-Frank Act, is expensive and time-consuming.